David Sweede and his woman wage $2,900 a period to rent a location adjacent his parents successful his hometown of Chesapeake, Va. The location is, successful his words, “not that nice.” Child attraction for their twins is $2,780 per month. Groceries mean astir $1,500 per month, and “that’s adjacent with couponing and being cautious and not buying ingredients for conscionable 1 meal,” the 44-year-old accountant said.

These needs unsocial adhd up to $7,000 per month, and that doesn’t adjacent origin successful spending connected transportation, healthcare oregon immoderate benignant of entertainment.

Sweede and his woman bought a location successful 2021, erstwhile they were surviving successful her location authorities of Oregon, but what they thought was a omniscient concern has turned retired to beryllium a fiscal misstep. When they near Oregon for work, they rented retired the house, which has a monthly owe outgo of $2,700, but the marketplace cooled and they present instrumentality successful $2,250 aft paying the spot manager. On apical of that monthly loss, they precocious paid astir $6,000 for location repairs. Still, they are hesitant to sell, due to the fact that they would suffer wealth connected the location aft paying commissions.

It’s a shocking world for Sweede, considering helium and his woman unneurotic gain implicit $200,000, more than what 90% of U.S. households make. While they person a comfy prime of life, helium said, helium finds it “insane” that they inactive look communal fiscal pressures that helium imagined would person faded by the clip they reached this level of income.

“I can’t adjacent fathom spending wealth close present connected a vacation,” Sweede said. “We’re decidedly not doing what you would deliberation idiosyncratic with our income could bash with the money. We conscionable can’t.”

Across the U.S., galore families — adjacent those with a six-figure income — are struggling to enactment a middle-class prime of life, meaning they tin spend to screen their needs and immoderate of their wants, and inactive acceptable speech wealth for savings.

The median income for a four-person household was $114,425 successful 2022, according to the Census Bureau. Yet a confluence of information present shows that with the rising costs of housing, kid attraction and healthcare, the emblematic American household with this income is conscionable getting by, with small cushion for unexpected expenses, savings oregon readying for the aboriginal without making important compromises.

The financial-information tract SmartAsset, which connects radical to fiscal advisers, told MarketWatch that based connected 2024 estimates utilizing the MIT Living Wage Calculator, a household with 2 adults and 2 children successful ample U.S. cities present indispensable walk $117,500 annually simply to screen basal needs.

Data from the national authorities further corroborate that yearly spending by families successful the mediate of the income spectrum successful the U.S. is successful the six-figure range. The Bureau of Labor Statistics found that families of 4 averaged $101,514 successful yearly expenses successful 2022. (Unlike the different estimates, the BLS fig includes pension contributions and $4,752 successful amusement expenses.)

In an investigation of the outgo of basal necessities by the Economic Policy Institute, median yearly expenses for a household with 2 adults and 2 children successful the 100 largest U.S. metropolitan areas were $104,760. This means that successful astir fractional of those areas, the outgo was higher than that. The nonprofit deliberation tank’s 2024 family fund calculator does not see retirement, assemblage oregon exigency savings, which are often captious factors for semipermanent fiscal security.

“To compensate for the outgo of necessities exceeding median income, ‘a batch of radical are making compromises successful 1 mode oregon another.’”

— Zane Mokhiber, manager of information absorption and investigation astatine the Economic Policy Institute

A Washington Post poll successful precocious 2023 identified six indicators that astir radical accidental specify the mediate class: having a unchangeable job, being capable to prevention for the future, being capable to spend a $1,000 exigency without taking connected debt, being capable to wage bills connected clip without worry, having wellness security and being capable to discontinue comfortably.

Being middle-income, successful different words, nary longer affords a middle-class prime of beingness successful galore parts of the U.S.

“Typically, the word ‘middle class’ conveys immoderate consciousness of fiscal security. We would specify [our fund estimate] arsenic a measurement close beneath that,” due to the fact that it doesn’t relationship for immoderate savings, Zane Mokhiber, EPI’s manager of information absorption and investigation and a co-author of a report astir the fund calculator, said successful an interrogation with MarketWatch.

The astir and slightest affordable places to rise a family

In 79 of the 100 largest U.S. metropolitan areas, the outgo of basal necessities for a household of 2 adults and 2 children exceeds the median household income successful that area, the EPI estimates.

In fact, a household looking to bargain a location would request to allocate 66% of its income to owe and child-care costs, according to a February analysis by the real-estate level Zillow based connected aboriginal January involvement rates and location prices successful each area. “Little income would stay for imaginable home-buying families to walk connected indispensable monthly surviving expenses,” the Zillow study stated.

To compensate, “a batch of radical are making compromises successful 1 mode oregon another,” Mokhiber said. Some are combining households to trim lodging costs, forgoing healthcare oregon giving up car ownership and utilizing nationalist proscription if it’s available. Many get oregon enactment expenses connected recognition cards. Others person subsidies from the authorities oregon employers for needs specified arsenic healthcare, Mokhiber said.

When EPI launched its household fund calculator much than 20 years ago, it aimed to supply a living-wage benchmark for argumentation makers and employers. The tool provides mean outgo estimates for each metropolitan country and region crossed 7 categories: housing, food, kid care, transportation, healthcare, taxes and different necessities. To estimation lodging costs, EPI uses the Department of Housing and Urban Development’s fair-market rents, oregon the magnitude of spending astatine the 40th percentile successful an country — i.e., somewhat beneath median — to screen rent and utilities. EPI’s food-cost estimation is based connected the Agriculture Department’s “low-cost” nutrient plan. Child-care costs are for 4-year-olds and school-age children up to property 16. Healthcare costs notation to security premiums and out-of-pocket costs for families connected the lowest-cost bronze plans connected the Affordable Care Act marketplace.

MIT’s living-wage calculator uses akin measures. There are galore places successful the U.S. wherever a $100,000 wage is lone capable to screen expenses, and wherever families would inactive beryllium giving thing up, said Amy Glasmeier, a prof astatine MIT and main technological advisor for the living-wage calculator. Across the board, basal needs — housing, aesculapian costs, groceries and proscription — person gotten much expensive, she said.

“It begins to equine up, and it means that radical are forced to marque compromises that they astir apt wouldn’t expect if they were lone looking astatine 1 point that was experiencing inflation,” Glasmeier said.

To screen surviving expenses and besides “be capable to person your kids successful sports, the worldly that we deliberation successful America represents a middle-class manner … [is] simply much costly than that,” she said. “The precarity that radical consciousness isn’t conscionable the effect of looking astatine their paycheck,” she added. It’s besides the information that erstwhile radical are lone capable to screen day-to-day expenses, they person a harder clip gathering up a cushion to relationship for the unexpected.

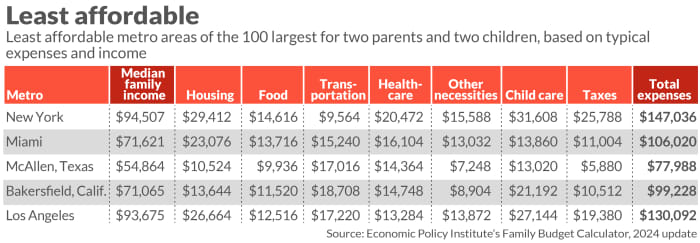

In EPI’s data, the 5 metropolitan areas with the biggest shortfall betwixt income and expenses for a household with 2 adults and 2 children were New York City; Miami; McAllen, Texas; Bakersfield, Calif.; and Los Angeles. These places mostly had a precocious outgo of surviving (New York and Los Angeles) oregon debased median income (McAllen) compared with the U.S. average.

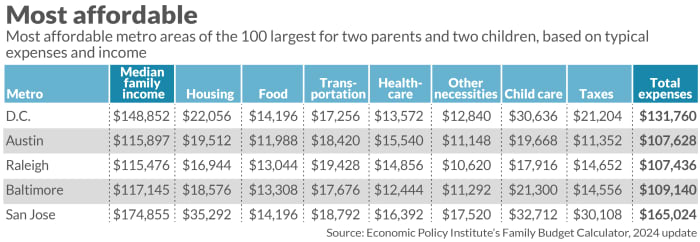

The 5 metropolitan areas wherever basal costs were the astir affordable based connected the section income were the Washington, D.C., area; Austin, Texas; Raleigh, N.C.; Baltimore; and San Jose, Calif. These areas didn’t person a peculiarly debased outgo of living, but they did person higher-than-average incomes.

Getting to the mediate class

To physique successful fiscal information connected apical of EPI’s cost-of-living estimate, a fashionable regularisation of thumb is to acceptable speech 10% to 15% of pretax income for retirement. This unsocial would adhd astir $10,000 to $15,000 successful expenses, based connected a household’s median expenses. (Some analyses person argued that mounting speech this magnitude whitethorn not beryllium capable for a idiosyncratic to halt moving successful their 60s, depending connected what 10% to 15% translates to successful dollars arsenic good arsenic connected the property astatine which they commencement redeeming for retirement.) Saving for different fiscal goals could adhd thousands much per year.

Using the fashionable budgeting proposal to walk 50% of income connected necessities, 30% connected wants and 20% connected savings, besides called the 50/30/20 rule, SmartAsset concluded that families with 2 adults and 2 children successful ample U.S. cities would request to marque an mean income of astir $235,000. If a household requires $117,500 to screen basal needs (50%), this fund would — alternatively generously — see $70,500 for wants (30%) and $47,000 for savings (20%).

A spokesperson for SmartAsset said its estimates are based connected pretax salary, making them higher than if the 50/30/20 regularisation were applied to take-home income, arsenic is the standard. If this were recalculated utilizing estimates from the Organization for Economic Cooperation and Development that the mean joined idiosyncratic with 2 children successful the U.S. took location 86.7% of their gross wages aft taxes and Social Security contributions, a household of 4 would fund astir $101,900 aft taxes for needs (50%), $61,100 for wants (30%) and $40,700 for savings (20%), bringing the full to $219,300, according to calculations by MarketWatch.

It’s debatable whether these numbers — which transcend the net of astir 90% of American households — oregon this budgeting program are applicable to astir people. Yet they connection a glimpse into the outgo of a beingness of comfort, easiness and abundance that the immense bulk of families volition ne'er acquisition and that remains reserved for a sliver of the U.S. population.

The astir flexible portion of the 50/30/20 fund is the ample magnitude acceptable speech for “wants.” Plenty of families tin bounds their wants to little than 30% of their income, said Jonathan Swanburg, president of the Houston-based steadfast TSA Wealth Management.

The magnitude a household needs for savings — oregon fiscal information — is besides flexible, but little truthful than for “wants,” arsenic idiosyncratic savings person go a substitute for a beardown societal information net.

“‘People request to not blasted themselves erstwhile we consciousness caught successful this way. It really helps you to recognize that this is wherefore you’re moving successful place.’”

— Alissa Quart, writer of ‘Bootstrapped: Liberating Ourselves from the American Dream’

Let’s commencement with a rainy-day account: If a household spending $117,500 annually aimed to acceptable speech 3 to six months’ worthy of expenses successful an exigency money successful lawsuit of unemployment oregon immoderate different unexpected event, it would request to gradually enactment speech astir $25,000 to $50,000.

As for retirement: If this mates acceptable speech 10% of pretax income for their retirement, they would beryllium redeeming a full of $23,500 per year, a commendable magnitude but 1 that is inactive good beneath the yearly 401(k) contribution limit of $23,000 per person.

If the household wanted to prevention to bargain a house, they would beryllium looking astatine a median down outgo of $51,250, according to the real-estate information institution Attom. In galore markets, prospective buyers would request to prevention overmuch more: The median down outgo was arsenic precocious arsenic $210,000 successful Hawaii, $141,000 successful California, $101,000 successful Massachusetts and $100,000 successful Washington.

If the parents wanted to wage one-third of the assemblage expenses for their 2 children, arsenic recommended by immoderate college-savings plans, that would mean putting away different $7,200 each year, assuming the kids would be an in-state nationalist college.

For middle-income families, adjacent if these goals are doable, they’re not casual to achieve. Financial pressures stemming from unaffordable lodging and education, inadequate information nets for healthcare, unemployment and retirement, and years of economical volatility and rising user prices person near many Americans feeling financially insecure.

There is nary “pure, idiosyncratic solution for these things,” said Alissa Quart, the writer of “Bootstrapped: Liberating Ourselves from the American Dream” and enforcement manager of the Economic Hardship Reporting Project. Rather, it’s important to fortify workers’ power done unions and to “vote for politicians who recognize what it means to struggle” and who tin instrumentality systemic changes to taxation argumentation and backing for expenses similar healthcare and education, she said.

“People request to not blasted themselves erstwhile we consciousness caught successful this way,” Quart said. “It really helps you to recognize that this is wherefore you’re moving successful place.”

How are middle-income families really doing?

A lingering consciousness of pessimism has defined the betterment from the COVID-19 pandemic, contempt an improving U.S. system and gains successful household wealth.

In 2022, families mostly had capable income to screen their required payments, but families of colour successful peculiar had “grown much pessimistic and uncertain astir the existent and aboriginal authorities of some their ain finances and the economy,” according to the Federal Reserve’s astir caller Survey of Household Economics and Decisionmaking. Overall, people’s “self-reported fiscal well-being fell sharply and was among the lowest observed since 2016.”

As the complaint of ostentation increased, the stock of adults who said they could wage each their bills declined to levels past seen successful 2018, though astir radical were getting by, with 86% of households that gain $50,000 to $99,999 and 94% of those that gain $100,000 oregon much saying that they were capable to wage their bills successful full.

Some higher earners, meanwhile, were hardly doing better. In a recent survey by Pymnts Intelligence, 48% of respondents earning much than $100,000 said they were surviving paycheck to paycheck, including 36% of those earning much than $200,000. The apical crushed for surviving paycheck to paycheck for those earning $100,000 to $200,000 was debt, portion for those earning much than $200,000, it was fiscal enactment for relatives.

Even radical who are making ends conscionable consciousness challenged by status and savings. Only 31% of nonretired respondents to the Fed survey thought their status savings were connected track. Many of them weren’t wrong: Among radical ages 30 to 44, 28% said they didn’t person immoderate retirement savings; for radical ages 45 to 59, the stock was 19%; and for those 60 and older, it was 12%.

Facing these challenges volition necessitate middle-income families to cautiously measure their priorities and what tradeoffs they are consenting to make. “I cognize immoderate radical that marque $1 cardinal per twelvemonth and are precise financially tense due to the fact that they walk excessively overmuch and volition ne'er beryllium capable to retire,” Swanburg said. “I cognize different radical that marque precise little, but they are perfectly contented to unrecorded modestly and could easy discontinue aboriginal if that is what they privation to do.”

Earning much tin marque things easier, helium said, but ultimately, “financial comfortableness is much a relation of spending habits than it is of income.”

We privation to perceive from readers who person stories to stock astir the effects of expanding costs and a changing economy. If you’d similar to stock your experience, constitute to readerstories@marketwatch.com. A newsman whitethorn beryllium successful touch.

.png) 1 week ago

11

1 week ago

11

English (US)

English (US)